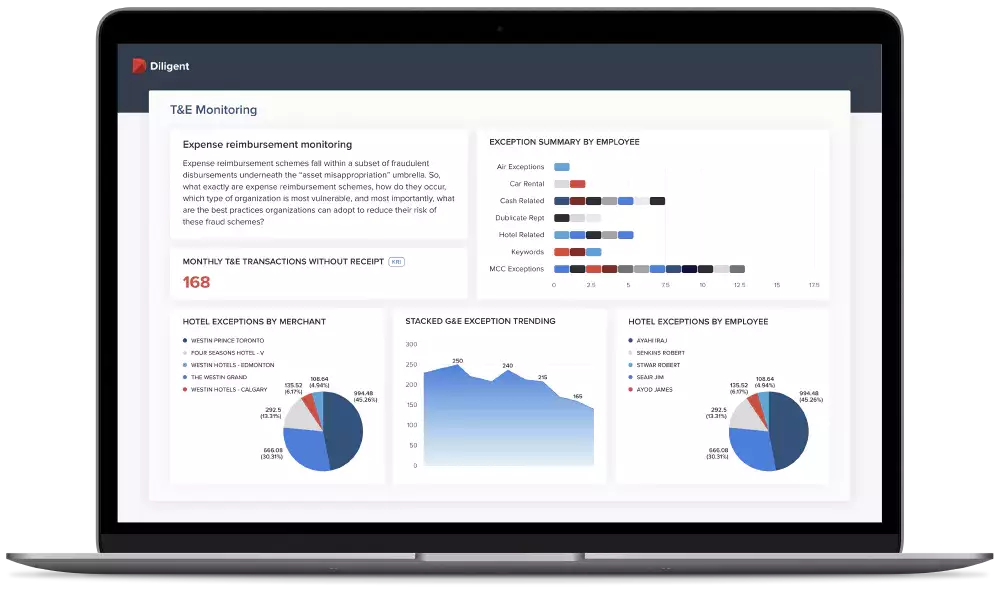

Audit Management is for Internal Audit teams that aim to go beyond the traditional way audits have been conducted and push the audit function into a strategic advisory role in their organization. Audit Management allows them to increase efficiency in their current processes with the power of data and automation, while offering deeper information so they can advise the C-suite and the board.

Menú

Cerrar

- Home

- Services

- About RISCCO

- Knowledge Center

KNOWLEDGE CENTER

Be an agent of positive change in the security of your organization

Visit our knowledge center and find out about news, tips, studies and exclusive research that RISCCO develops for the public.

- Contact

- Home

- Services

- About RISCCO

- Knowledge Center

KNOWLEDGE CENTER

Be an agent of positive change in the security of your organization

Visit our knowledge center and find out about news, tips, studies and exclusive research that RISCCO develops for the public.

- Contact

Panamá

Panamá

CARICOM

English

-

CARICOMCARICOM

Antigua and Barbuda, The Bahamas, Barbados, Belize, Dominica, Grenada, Guyana, Haiti, Jamaica, Montserrat, Saint Lucia, St. Kitts and Nevis, St. Vincent and the Grenadines, Suriname, Trinidad and Tobago, Anguilla, Bermuda, US Virgin Island, British Virgin Islands, Cayman Islands, Turks and Caicos Islands

Antigua and Barbuda, The Bahamas, Barbados, Belize, Dominica, Grenada, Guyana, Haiti, Jamaica, Montserrat, Saint Lucia, St. Kitts and Nevis, St. Vincent and the Grenadines, Suriname, Trinidad and Tobago, Anguilla, Bermuda, US Virgin Island, British Virgin Islands, Cayman Islands, Turks and Caicos Islands

-

Panamá

CARICOM

English

-

CARICOMCARICOM

Antigua and Barbuda, The Bahamas, Barbados, Belize, Dominica, Grenada, Guyana, Haiti, Jamaica, Montserrat, Saint Lucia, St. Kitts and Nevis, St. Vincent and the Grenadines, Suriname, Trinidad and Tobago, Anguilla, Bermuda, US Virgin Island, British Virgin Islands, Cayman Islands, Turks and Caicos Islands

Antigua and Barbuda, The Bahamas, Barbados, Belize, Dominica, Grenada, Guyana, Haiti, Jamaica, Montserrat, Saint Lucia, St. Kitts and Nevis, St. Vincent and the Grenadines, Suriname, Trinidad and Tobago, Anguilla, Bermuda, US Virgin Island, British Virgin Islands, Cayman Islands, Turks and Caicos Islands

-